Índice do artigo

Procurement Relevance: Where to even start when you’re buried in the weeds

You probably recognize this scenario: You’re working in procurement in an organization, and rather than doing what you’re supposed to do, you’re being run off your ass because the CFO “wants savings” – with probably no spend baseline established, cost avoidance not being recognized as “savings” – you’re entering a territory of endless discussions, and at the end, it’s never enough – and procurement is viewed as a failure.

Let me put this observation in context. I attended a procurement conference a few months ago, where the audience was asking questions to a panel of (respected) people that work in the procurement profession.

The audience itself consisted of procurement people (who is interested in attending procurement conferences if you don’t work in procurement?) – and it was one of those evenings where what you were thinking were validated by similar experiences of your colleagues (and you thought you were alone in this world, probably thought it is your fault)

The theme of the evening was the future of procurement (I am assuming that there will be one, but if we don’t get our collective asses in gear, there might well be not a future for us in this profession, let alone the profession itself).

Most of the panel were CPOs from large(r) companies. The discussion, as they go in events like this, had been generally the usual friendly nodding and agreement (we are colleagues after all) – fortunately, the panel contained one or two procurement characters who are known to hold strong views, and are not shy about voicing those opinions (I am withholding names to protect the innocent)

Do you think that procurement should be measured on savings?

I found this question to be of particular interest – not in the least because reality would indicate that procurement reports into finance, and these airheads understand just one principle – “savings” – thus driving peculiar behaviors and attitudes.

I thought it was of particular interest in how the question was asked, as one could very easily have added “surely not” at the end of the question.

I thought is was a “funny” question, especially as the word “savings”. Or any other word to denote monetary benefits) has become a dirty word in procurement in recent years, as if people in the profession are ashamed of talking about it.

It’s certainly less fashionable to talk about savings at events such as this one, where surely there must have been some fascinating topics that could be talked about – like ERP, or digitalization – surely procurement could aspire to more than just “savings” after all these years?

Why is that “savings” has become a dirty word in procurement circles?

Perhaps it’s because savings programs have failed, or that CPOs have been unable to savings into wider business-speak and therefore constantly come up against a corporate brick walls.

Then there are the CFOs who have learned “never to trust a procurement savings number”.

All of a sudden, the entire industry seems to be nervous to associate themselves with the very thing they all thought they specifically existed for, just a few years ago.

It’s an interesting reality, and I was eager to see how this would all play out.

First up was a CPO from one of the world’s largest engineering Firms, and she stated that the function she was leading was “past that”.

Indeed, according to her, her latest strategic plan didn’t even have a savings target attached to it. She went on to explain that for her, and the company she worked for, success metrics they used are engagement levels with the business function, automation, and “quality” (whatever that means).

Finally, and only in her closing comments, did she admit that savings were sometimes used as a metric, but only “where appropriate”, and then only for certain projects.

It was then the turn of the CPO of a water utility to answer the same question. he seemed to be just as keen not to be seen as a savings CPO.

I think we are “way past that” he said. Apparently, his function gets measured on many other elements such as customer satisfaction, supply chain satisfaction, sustainability, and even carbon neutrality.

But then he too began to introduce a nuance towards the end of his answer.

“I think many CEOs and CFOs see savings as a given”, he said. “One has to be, and remain, cost competitive in the market”, before adding “I think other types of value are secondary to that”, With that comment his voice trailed off, and he appeared to brace himself for the reaction from the audience and his fellow panelists.

After all, he had just done a U-turn and sorta admitted to a few hundred of his peers that savings were in fact the number one priority of the function.

The third speaker nailed it, for me. He was the CPO of a large CPG, and he spoke confidently: “the fact is, savings are important”, he explained.

“If you inherit a procurement team that doesn’t have standing in the business then your ability to get credibility rests on setting a three-year value for money improvement, call it a savings if you like, and achieving it”.

He said that once you deliver credible savings, agreed to and signed off from your business partners and the CFO, then you get permission to expand into other things such as driving innovation in the supply chain, having goals around supplier satisfaction, and all the other worthy goals a procurement team should aspire to as well.

Yes, there are other things that a procurement function can and should eventually do to add value in ways beyond savings, but they come second to your prime objectives and the reason for your existence: generate hard savings.

Walk, then Run

What I took away from that exchange, confirmed what I have seen and experienced as a CPO myself, and then as a consultant.

Namely, many CPOs and procurement professionals aspire to be something other than people who save money.

That is excellent, because there is certainly much more to procurement than saving money, but much care is needed, and for sure, you’ll trip over yourself if you run before you can crawl.

The people on the procurement panel were all successful CPOs with mature procurement functions, and each had established themselves in their respective businesses – thus earning the right to go beyond savings in pursuit of more corporate value.

However, in public these days, even these people throw in the savings piece as an afterthought, almost, as if it isn’t important. And that, in my opinion, is the wrong message.

This represents, I my opinion, a bizarre state of affairs. After all, didn’t procurement initially get established to be the commercial conscience of the organization?

I’ll answer that question for you. Yes, it did.

When companies realized just how much of their spend was going to third parties, they saw an opportunity to professionalise the way they purchase the goods and services they need – to generate synergies and to remove costs.

So… How to Proceed?

The reality is that procurement can probably boost corporate profit by 30%. The problem with this, is that this probably is only true the first time you really put your effort in it.

After that, well get used to diminishing discount levels (just as your own company would not continue to give discounts on a baseline from 5 years ago.

Your costs go up – and so does the price. And herein lies the conundrum. To grab that first opportunity, is why procurement exists in the first place.

And if you don’t grab that opportunity by the horns, you’re probably waging a losing corporate battle for relevance and value.

It’s important to understand, and embrace the concept, that your company gets better value from the supply market.

Those are savings. They are not restricted to price reductions. But you do need to get consensus and buy-in – sign off. It can, and must, include savings on total costs – for example, if you buy a more expensive part that lasts longer, thus costs less over the lifecycle of that part over a component that costs less but doesn’t last as long. Even cash flow improvements, if cash is important to the company.

The issue you’ll need to be aware of, is that your egghead CFO will probably not count this in as a ”savings”. It’s therefore crucial that you get stakeholder acknowledgement and buy-in/sign-off, BEFORE you go knock on the CFO’s door.

The difficulty of understanding your starting point is compounded by the fact, based on observation after observation, that procurement people sometimes think that they’re better than they really are. This is not because they’re arrogant, in general, it’s because they have a different understanding of what procurement is achieving in their company today than most of their peers in that same function.

For example, procurement often quotes savings figures it has delivered, but how much of those savings are believed by the rest of the company.

Remember – stakeholders buy-in and sign-off first, THEN the CFO (if necessary, accompanied by your stakeholder who can vouch for your claims) This is critical. Without that common understanding, your claims of savings will not give you credibility.

And… if your procurement aspires to pursue other causes other than just savings – it needs to be credible on savings first.

How does on define “savings”?

A savings is a reduction in costs versus current or historical costs. In procurement, that can take a number of forms:

- We can reduce the price of the item or service;

- We can swap the item for a more cost-effective specification;

- We can receive an annual rebate based on volume or contract length;

- We can link our purchases to an index to ensure we’re not paying more than market evolution;

- We can affect a total cost of ownership savings (for example, buying a more expensive pump that lasts twice as long)

As you can deduce, procurement is not just (should not just) be about cost reduction, although it’s a crucial fist step.

For instance, if over time specifications change, then procurement ought not to claim the resultant cost reductions as “savings”.

So, what should not count?

Business-driven volume changes, for one thing. If you close one of your three factories, you might reduce your facility expenses by a third.

Clearly not a savings that procurement should/can claim.

Market-driven commodity pricing changes are also not defensible, but the same applies if the price goes up, in which case procurement should not be penalized (think about commodity indexing to limit margin erosions)

Which leads to the gray area of cost avoidance – and the innumerable discussions you’ll be having with your finance colleagues Cost avoidance is simply where you avoid a price increase that you would otherwise have to absorb.

I would advise to not claim credit for cost avoidance, unless that avoidance was the result of a deliberate sourcing strategy.

Beyond this, any “quantifiable” cost reduction is fair game – Note the word “quantifiable” – to be in a position to quantify anything, you must have reliable and credible data.

Savings need to be delivered before they can be measured

Of course, savings need to be delivered before they can be measured (although not always the case in the minds of some procurement professionals – savings should be recognized as soon as the contract is signed (mistake), unless you ant to sabotage your own credibility).

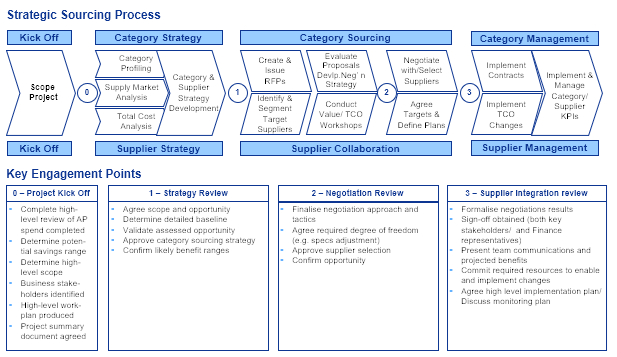

When it comes to savings delivery, that needs to come through a proper strategic sourcing project.

You will need to make a distinction between fundamental cost reductions, and business-as-usual savings.

BAU savings are usually a mixed bag of savings, some more bankable than others. It’s basically anything that anyone can articulate, and then it’s thrown in the mix.

Business-as-Usual savings include discounts of supplier list prices, improvements between quote 1 and quote 2, improvements against budget, cost avoidance (including the avoidance of proposed supplier price increases), one-off discounts associated with large orders, ad so on.

Some of these, then, will be impossible to find in the P&L, because they were more constructs (e.g. Bid 1 against Bid 2), and make no difference in what we spend, in reality.

So, it pays, (pardon the pun) to harvest what I refer to as “structural savings” – savings that come from basically re-setting the cost base, by doing something differently, on an annualized or even quarterly basis.

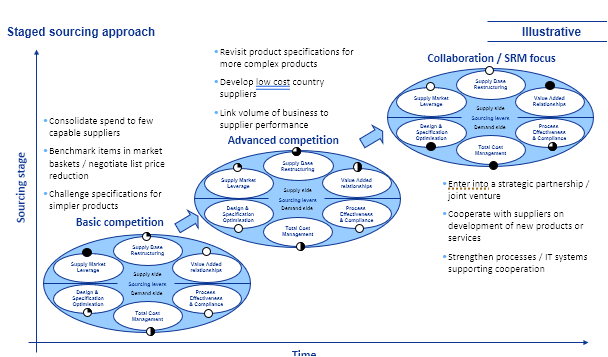

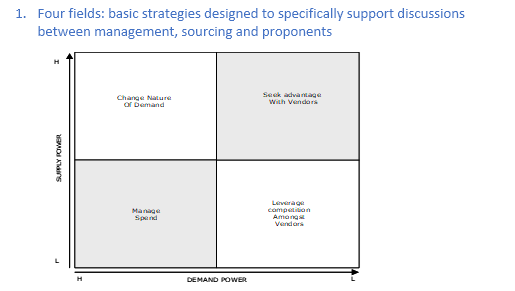

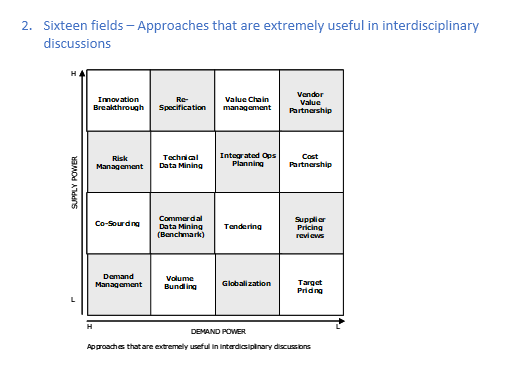

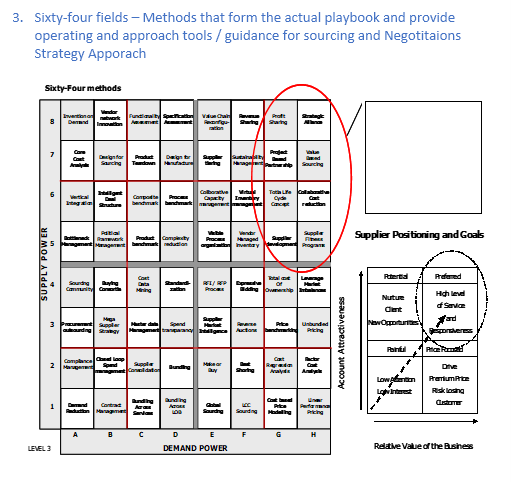

As a reminder, Kearney’s sourcing strategy board.

Here are some examples of a sourcing-driven cost reduction strategy.

“Outsourcing facilities management services to a Tier 1 FM partner in North America and China” , strategically sourcing machined metal parts from a network of 11 approved global suppliers with dynamic volume allocation”, “strategically sourcing travel by agreeing and implementing a strict new global travel policy, appointing a new global travel partner, and putting in place airline route deals, a global car rental deal, and two preferred hotels for all core locations”. Those are what I would call savings.

So, to conclude: Step 1 is to deliver, operationally if you like, the savings. Step 2 is to articulate, measure, and realize those savings – two separate, but linked, challenges.

Last, the elephant in the room: compliance

Another dreaded word… compliance. You would not believe what I have see in the corporate world – absolute lack of backbone, willingness, or even “cohones” – in implementing a compliance structure.

There’s simply no point in negotiating contracts if you’re not going to force compliance in purchasing against existing contracts.

And the problem with compliance is that in many instances, procurement intervenes to conduct a sourcing event, and then pulls out, way before compliance or non-compliance can even manifest itself.

There is an assumption that there will be savings, there is an assumption that everyone will adopt the new supplier, and there are assumptions that suppliers will actually honor the pricing promised in the RFP response. But nobody check!

And the reason nobody checks is that the procurement professionals pull out after the contract is signed, while the budget-holders are not at all bothered about the savings details.

In fact, in my experience, it’s almost “normal” for the ongoing management of categories and suppliers to completely fall between two stools in organizations. No wonder then, that compliance sits at 27%.

So how exactly should you go about compliance management?

The first solution is the simplest: all negotiated goods and services can only be procured through a corporate catalog, which is configured to allow for purchasing decisions based on function (and probably level) in an organization (think how you buy “stuff” on Amazon – it’s easy, you have choices, it takes less than a minute) – compare that to the insanely archaic and complex ERP-drive catalog solutions (I am generous calling them “solutions”) . You need to make buying against a contract easy, and painless. Otherwise, you’ll fail.

What you should avoid having to do is to go to finance, let them run an AP or GL extract, where you then can determine who bought what from whom – it’s too late, dudes.

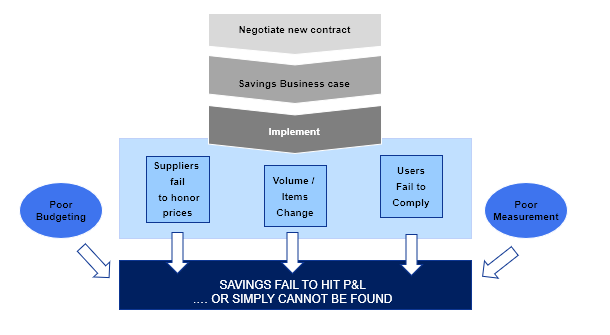

Let’s talk about savings leakage points

You’re probably quite familiar with the “what happened to the savings you promised me”? discussions with finance.

Did the savings just not happen, despite being reported? Or did they happen and the nerdheads in finance just aren’t able to pinpoint in the P&L extracts?

Well, reality is that there are a number of possible “leakage points” (it’s why supplier management should be considered, but that’s another topic for another day). One vexing issue is that, typically, there’s a lack of willingness to assume “category or spend ownership” – so who’s managing suppliers, compliance, preservation of savings and contract compliance? (yes, the answer is supplier management)

These leakage points combine to erode savings, and the more of them you can plug, the more of them you’ll be able to recognize and “official savings” .

To sum it all up…

The key steps you can take to avoid savings leakage are:

- Get your savings / business case right, get stakeholder buy-in and confirmation, making sure that your calculations are based on granular volume and pricing data, and it makes reasonable assumptions

- Ensure that the supplier contract gets properly implemented, and that all business units or divisions are aware of the new contract and how to buy from it

- Consider driving all goods and services through a corporate catalog, configured as if you were buying from Amazon

- Make sure someone is accountable for measuring and managing supplier, item, and price compliance – without this, you will fail. Engage stakeholders and finance early, get stakeholder buy-in and support, and then get finance to sign-off to the savings as well

- Make sure that you measure both operational and budget savings, stripping out any extraneous factors, such as business-driven volume or mix changes to the possible extent – use compliance data to prove savings realization

- Think about using “as system” to track the evolution of savings by category over time, to avoid surprises and manage expectations.

Listen, a procurement function’s reputation and credibility lives and dies by the validity of its proclaimed savings. For any CPO, getting this part wrong should be a firing offence.

Procurement, and its stakeholders, needs to be fully and proactively engaged in the savings measurement process both during and after the sourcing process, and it’s the CPOs job to ensure that first, stakeholders and then finance, are engaged from Day One

It’s all about being proactive, data, and relationship management. Never go to a meeting without data and facts; never ask questions if you don’t know the answer, and always come prepared with suggestions and solutions, not just questions

Hans van Eck-Casteels

O Professor Hans van Eck-Casteels, uma verdadeira autoridade no campo e com um currículo impressionante, já colaborou com empresas renomadas como IBM, van Eck Private Equity, Carlyle, KKR, Blackrock, France Telecom/Orange e AT Kearney.

Sua vasta experiência abrange otimização de custos, compras estratégicas, gerenciamento de riscos, estratégias de gerenciamento de fornecedores, bem como estratégias de TI e digitalização.

Além disso, o Professor possui certificações em Lean Six Sigma Green Belt, PMP, IA, Blockchain e Design Thinking, e é mestre em Economia pela prestigiosa Universidade de Oxford.